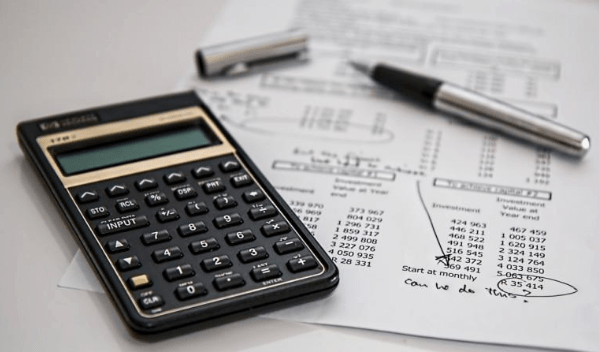

Managing personal loans is an integral part of personal finance. One of the most vital aspects to consider before availing of a personal loan is understanding your repayment capacity and planning your EMIs (Equated Monthly Installments) properly. This is where a personal loan EMI calculator steps in as a practical online tool to help borrowers make informed financial decisions.

In this article, we discuss how to use a personal loan EMI calculator effectively, how it can help with repayment planning, and why evaluating key factors, such as a 2 lakh personal loan EMI for 5 years, can significantly impact your finances.

What is a Personal Loan EMI Calculator?

A personal loan EMI calculator is a free, online tool offered by banks, lenders, and financial websites that helps you determine the monthly installment you’d need to pay after borrowing a specific loan amount. When you input the loan amount, interest rate, and loan tenure, the calculator provides a clear estimate of your EMI.

This tool makes it convenient for borrowers to plan their repayment schedule in advance, ensuring they are financially ready to manage the loan without disrupting their monthly budget.

EMI calculators are particularly helpful when you’re considering loans of varying amounts and durations, such as calculating a 2 lakh personal loan EMI for 5 years, as they simplify comparisons between different repayment scenarios.

Key Features of a Personal Loan EMI Calculator

When you use a personal loan EMI calculator, you benefit from several essential features:

1. Ease of Use

The calculator interface is typically user-friendly and highly intuitive. You only need to enter three parameters:

Loan amount (e.g., 2 lakh)

Loan tenure (e.g., 5 years)

Interest rate offered by the lender

Once entered, the calculator immediately displays the EMI amount, saving time and effort.

2. Precision in Calculations

Since manual EMI calculations can be prone to errors, a personal loan EMI calculator ensures 100% accuracy. This enables borrowers to plan their finances more effectively.

3. Customizable Inputs

Borrowers can experiment with different loan amounts, durations, and interest rates to compare repayment plans. This flexibility helps you determine what works best for your financial situation.

4. Breakdown of Total Payments

A good EMI calculator shows the breakup of principal and interest components of your loan. For instance, when exploring a 2 lakh personal loan EMI for 5 years, the calculator will specify how much principal you’ll repay, as well as the total interest payable over five years.

Benefits of Using a Personal Loan EMI Calculator

1. Helps Assess Loan Affordability

The personal loan EMI calculator is an excellent tool to evaluate your repayment capacity and ensure that you’re not overstretching your finances. The results help you budget your monthly expenses so that the EMI comfortably fits into your income.

For instance, a 2 lakh personal loan EMI for 5 years can be evaluated across various interest rates to understand how it impacts your income and expenses.

2. Saves Time and Energy

Manually computing EMIs through the EMI formula can be tedious and time-consuming. Using an online personal loan EMI calculator eliminates this hassle by providing instant results with just a few clicks.

3. Informs Better Financial Decisions

Understanding the long-term cost of borrowing is crucial. A personal loan EMI calculator reveals the total interest payable over a loan tenure, enabling you to compare multiple loan options and choose the most cost-effective one.

4. Enhances Financial Planning

The calculator helps you schedule your future payments. For example, if you take a loan today, you can estimate the additional monthly expenditure and adjust other expenses to ensure a smooth cash flow.

Assessing a 2 Lakh Personal Loan EMI for 5 Years

Let’s delve deeper into how a personal loan EMI calculator can be used to analyze a 2 lakh personal loan EMI for 5 years.

Assume a lender offers you a loan amount of ₹2,00,000 for a tenure of 5 years (60 months) and charges an annual interest rate of 10%. By entering these details into a calculator, you’ll find:

EMI Amount: ₹4,249 per month

Total Payment Over 5 Years (Principal + Interest): ₹2,54,928

Total Interest Payable: ₹54,928

This breakdown gives a clear picture of the financial commitment required to manage the loan. Additionally, the calculator allows you to tweak the interest rate or tenure to explore other costs and repayment strategies.

Now, let’s consider a second scenario where the interest rate is 12%. In that case, the EMI changes to ₹4,449, and the total payable amount increases to ₹2,66,971. This comparison highlights how minor changes in interest rate can affect your overall repayment.

Why 5 Years Makes a Difference

A tenure of 5 years for a ₹2 lakh personal loan ensures moderate monthly payments, but borrowers must note that the longer the tenure, the higher the total interest payable. For instance:

For a 3-year term at 10%, the EMI would be ₹6,447, with total interest costing about ₹31,910.

Compared to a 5-year term, longer durations incur almost double the interest cost, though monthly EMIs are lower and more manageable.

How to Use a Personal Loan EMI Calculator Effectively

To make the most of this useful tool, follow these steps:

Step 1: Gather Key Details

Before using the calculator, ensure you have details such as the loan amount, expected interest rate, and preferred tenure.

Step 2: Enter Details Correctly

Enter accurate details into the fields of the EMI calculator. For example, for a 2 lakh personal loan EMI for 5 years, input:

₹2,00,000 as Loan Amount

10% or applicable Interest Rate

5 years or 60 months as Tenure

Step 3: Analyze the Outcome

Review the monthly EMI amount, along with the total repayment (principal + interest). Evaluate whether this fits your financial capacity.

Step 4: Test Different Scenarios

Experiment with shorter durations, higher or lower interest rates, or varying loan amounts to see how EMI values fluctuate. This allows you to customize your repayment plan.

Step 5: Make a Decision

Once you have a repayment plan that suits your income and allows savings, proceed with your chosen loan option.

Factors That Impact Personal Loan EMIs

Several factors impact your personal loan EMIs:

Loan Amount

The higher the loan amount, the higher your EMI will be. Ensure you only borrow what you need to avoid overburdening yourself financially.

Interest Rate

This is a key determinant of overall loan costs. Even small differences in interest rates can significantly impact your total repayment.

Loan Tenure

Shorter tenures result in higher EMIs but lower interest paid. Conversely, longer tenures reduce EMIs but increase the total interest cost.

Prepayment and Other Fees

Always check for prepayment or foreclosure charges as these could influence your decision to repay the loan early and save interest.

Credit Score

A healthy credit score often translates into lower interest rates, further reducing EMIs. It’s essential to maintain a good credit history to avail of favorable loan terms.

Conclusion

Using a personal loan EMI calculator is an effective and convenient way to assess your repayment strategy before taking a loan. Whether it’s a small loan or a 2 lakh personal loan EMI for 5 years, the tool provides precise insights into your financial obligations, helping you prepare for timely repayments without financial stress.

The calculator ensures you don’t overstretch your monthly budget and allows you to experiment with different loan amounts, terms, and interest rates. By effectively utilizing this tool, you can make informed borrowing decisions, achieve financial security, and avoid the pitfalls of poor loan management.

So the next time you plan to take a personal loan, don’t hesitate to leverage the power of a personal loan EMI calculator—it’s your ultimate guide to simplified and stress-free loan management!